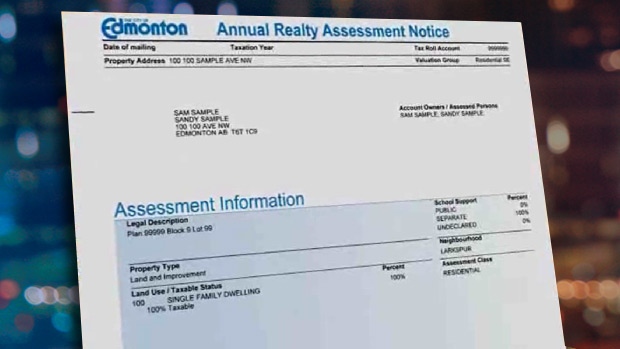

Officials have mailed out property tax assessments to Edmonton home owners – which show the value of the average single-family home in Edmonton, went up by just over one percent last year.

The city said tax assessments were completed on a total of 341,813 properties, reflecting their market value as of July 1, 2012.

The average single family home’s value increased by about 1.3 percent last year, while the assessed value of condominiums, townhouses and duplexes went up by about 0.5 percent, and the assessed value of apartment buildings went up by about 6 percent.

Records for all property sales are used to help assess the market value for all properties, in addition to factors such as building size, age, condition, and location.

Officials are encouraging property owners to review the assessed value of their property, and ensure the value reflects what it could have sold for on the open market.

Anyone with concerns about their assessment notices is urged to call 311, and speak to an assessor about it.

However, if concerns are not resolved – owners can file a written complaint with the Assessment Review Board, and that must be done by March 11, 2013.

Owners may appeal their assessment, but not tax bills.

Final tax notices will be mailed in May, after the municipal budget is confirmed, and the provincial government announces the education tax, which the city said often is about 35 percent of the total property tax bill.

The municipal budget was passed in December, and calls for a 3.3 percent tax increase – broken up with 2.2 percent for municipal services, and 1 percent for neighbourhood renewal.

The increase translates to slightly more than $100 added to the tax bill for the average home valued at $364,000.

However, some neighbourhoods saw increases and decreases in value that were very different from the average change.

“Year after year, neighbourhoods change at various rates,” Rod Risling, manager of the Assessment and Taxation Branch at the City of Edmonton said.

The neighbourhood that saw the largest increase was Ritchie, which went up by 9.4 percent – property owners in that area could see increases of more than $200.

In turn, Westridge saw the largest decrease in value, dropping 5.6 percent.

The city said the fluctuations tend to balance out over time – and this year overall, the value of a typical home saw a moderate increase.

“Generally, if your property increased the same as the average property increase in the City of Edmonton, 1.3 percent, you’ll see a 3.3 percent municipal tax increase,” Risling said.

With files from Bill Fortier