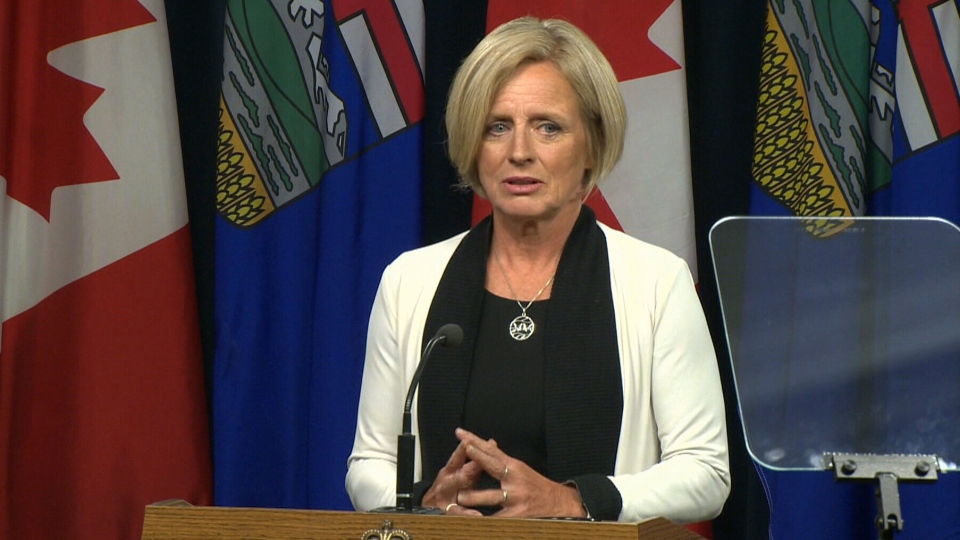

Energy companies want the Government of Alberta to put a cap on oil production as oversupply has significantly reduced heavy crude prices. Premier Rachel Notley won’t commit to implementing one, but she didn’t rule it out either.

Alberta companies like Cenovus Energy and Canadian Natural Resources (CNRL) want the provincial government to cap production in the hopes of mitigating the heavy crude differential.

The West Texas Intermediate (WTI)—the benchmark for oil prices—currently lists the cost of a barrel at US$56.56, but Western Canadian Select(WCS) is trading for US$14.65.

Randall Bartlett, an economist at the Institute of Fiscal Studies and Democracy, explains that Canadian prices have taken a plunge because demand is not nearly as high as production.

"There's just not enough demand to soak up all the supply," Barlett said.

“Canada is right now achieving the lowest price for oil in the world,” Cenovus CEO Alex Pourbaix said. “We are talking an emergency situation and a very serious situation.”

Research by Peters & Co. estimates the Alberta government will lose on approximately $5 billion in royalties if the gap between WTI and WCS stays the same in 2019.

Notley called the US$40 differential a “serious problem,” but stopped short of committing to a production cap.

“There are a suite of options in front of us right now, and involve some good conversations with industry players.”

Larger, more diverse energy companies with refineries, like Suncor and Husky, are more insulated from the export discounts. However, a government-imposed cap to reduce their production could hurt their business.

“What they’re really asking is for the government to choose one group and to favour that group with a piece of policy, and I just don’t think that can work,” said Warren Mabee, an energy policy expert at Queen’s University.

Economists do predict the gap could narrow when Enbridge’s Line 3 Replacement Program comes online in 2019.

With files from Dan Grummett