When Sharon Maclise takes a look at her 2008 property tax bill, she can't help but think something is wrong.

Her taxes increased by hundreds of dollars, but it's not the final figure she has a problem with.

It's the system.

"Market value taxation is simply a regressive type of tax," she said.

Maclise, along with a handful of other taxpayers, says the city should go back to calculating taxes the way it did before 1994.

Back then, property taxes were calculated based on provincial formulas for square footage and lot size.

"We should all be subject to consumer types of taxing, every tax that we pay must be consumer oriented," Maclise said.

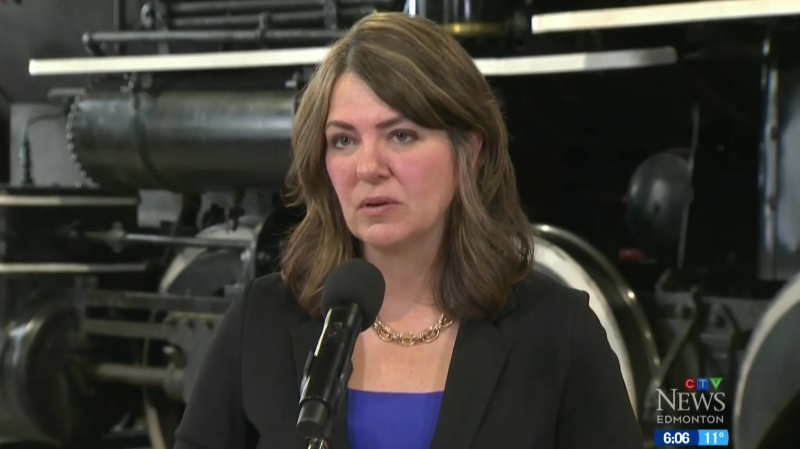

Ray Danyluk, Alberta minister of municipal affairs and housing, said even though the province sets the guidelines for the way city taxes residents, municipalities can always adjust the mill rate.

"It was the large centres in Alberta that asked the provincial government for market value assessment and we feel that it is probably the most equitable way of assessment," he said.

Despite the fact taxes rose an average of 7.5 per cent in 2008 -- with some neighbourhoods paying as high as 25 per cent -- Rod Risling said not as many people are calling the city to complain.

Risling, who works in the city's taxation department, said residents should brace themselves for even higher taxes next year.

"Regardless if market values double, triple (or) quadruples -- the amount of dollars the actual city brings in as whole is exactly the same," he said.

The figures work out because market value assessments are a way to distribute the budget requirements among all residents.

It's an idea Maclise said she doesn't agree with.

"The whole idea of property value is too nebulous, too difficult," she said.

With files from Deborah Shiry