EDMONTON -- The absence of a uniform process is creating difficulty for small business owners trying to apply for emergency federal loans.

Alberta operators told CTV News Edmonton banks each take applications for the Canada Emergency Business Account in their own way.

CEBA provides loans up to $40,000 via banks to companies with payrolls between $20,000 and $1.5 million.

If the loans are repaid by the end of 2022, up to 25 per cent of the loan may be forgiven.

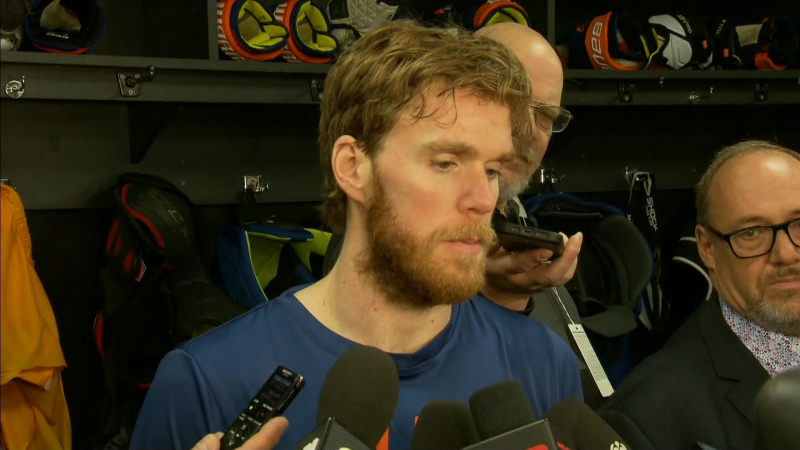

Igloo Heating AC and Refrigeration owner Landon Johnston said it appeared a great idea at first.

“It’s been tough,” he told CTV News Edmonton.

“I saw this loan, I thought this is a great idea. I qualify for it. I met all the requirements.”

However, he has struggled to submit an application to RBC, which only accepts requests from clients it believes will meet the criteria.

Some applicants may not even be allowed to start the process given RBC’s current website setup.

“I thought that was weird because I had checked with my accountant: I had checked with all the requirements,” Johnston said.

Other business owners reported similar problems.

In a statement, RBC told CTV News Edmonton “no one is excluded from applying for CEBA.”

It recommended customers call a CEBA hotline if they have trouble accessing the application online.

Johnston said he tried that and was promised to hear back from RBC within 48 hours. That was seven days ago, he said.

CEBA is capped at $25 billion.

It was created to help businesses through the economic challenges presented by COVID-19.

With a report from CTV News Edmonton’s Bill Fortier and CTV News Calgary