'Majority of people will still see an increase': Experts say Alberta auto rate freeze won't provide financial relief

The Alberta government says it is pausing private passenger vehicle insurance rate increases through the end of 2023 after hearing concerns from drivers about affordability.

“Many Albertans are being squeezed on the affordability front. We have, they’re dealing with inflation kind of right across the board. That inflationary impact has also affected the cost to repair vehicles and there’s concern that automobile insurance rates will be going up significantly and so we just want to create this pause so we can work with the industry,” said Travis Toews.

The province says while no new rate increases will be approved, some drivers may still see their rates go up because of previously approved rate hikes or changes to their driving records, such as at-fault claims or tickets, or changes to insurance profile, like a new vehicle or address.

The province will also require insurers to provide the majority of Albertans with the ability to pay their premiums through payment plans instead of paying the full amount up front.

Alberta previously had an auto insurance rate cap under Alberta Notley’s NDP government.

Jason Kenney’s United Conservative government lifted the cap when it was elected in 2019.

NDP leader Rachel Notley told reporters on Thursday the pause doesn’t go far enough.

“The fact that many people will still see increases this year because so many increases have already been approved, even though they have not shown up on people’s bills, is not good enough. The fact that they’re only planning to freeze until the end of 2023 is not good enough,” she said.

“It will end with the cap, any kind of freeze, coming off, and the UCP friends and insiders in the insurance industry continuing to charge the highest auto insurance rates in the country.”

'MOST PEOPLE WILL STILL SEE AN INCREASE'

One expert who works with auto insurance companies in Alberta says the freeze won’t provide any financial relief for drivers this year and could cause problems down the road.

“Albertans are not going to see any immediate financial relief from this, which is the troubling part, Barry Haggis, president of the Insurance Brokers Association of Alberta (IBAA) told CTV News Edmonton on Thursday.

"A rate pause or a rate freeze makes it seem like ‘Great, I will not have to pay more on my auto insurance on this renewal than I did last year,’ unfortunately that’s not going to be the case.”

Haggis says insurance companies apply for rate increases in advance, but customers don’t see them until their renewal date.

“The majority of people will still see an increase on their renewal,” he said.

Haggis says insurance companies have to justify rate increases to the Auto Insurance Rate Board, adding inflation is one of the things driving up rates.

“The cost to repair vehicles has gone up by 15 per cent in the last year. All signs point to that increasing again coming into 2023, so in order to pay claims, we need to have those premiums that match.”

Haggis says if insurers can’t raise premiums on drivers, they’ll look for other ways to cut their losses.

Under the previous rate cap, he says some drivers couldn’t qualify for auto insurance payment plans or obtain comprehensive collision coverage.

'THIS IS NOT A RATE CAP'

The UCP government will require insurers to offer payment plans, but Haggis says it’s unclear what that will look like.

“It might mean, ‘Ok, we have to offer a payment plan, but that doesn’t mean we have to offer monthly payment plans.’ Maybe it’s still a payment plan, but you have to pay 50 per cent now and 50 per cent in six months.”

He says there isn’t an easy solution to making auto insurance rates affordable in Alberta.

“During this pause, as we’re calling it, there needs to be serious, serious consideration, and a lot of thought put into a long-term solution for auto rates in Alberta.”

He says the IBAA reached out to the province last month and proposed pausing or scrapping the insurance premium tax of four per cent that is applied to all insurance policies in Alberta.

Haggis says getting rid of the premium tax would immediately put money back in consumers pockets.

“A 51-year-old single mother, with a 19-year-old daughter, and a 20-year-old son, with two vehicles in the household, would save $296/year by getting rid of the premium tax,” he said.

Toews defends the province’s decision, calling the move a pause, not a cap.

“This is not a rate cap. Rate caps that are implemented without an end date are extremely negative, and ultimately result in abhorrent behaviour by insurance providers,” he told reporters, referencing insurance companies refusing to provide payment plans or comprehensive coverage.

“We’ve reached out to industry and discussed the challenge ahead of us. Again, I’ve appreciated the cooperative tone they’ve provided, and I believe insurers will be patient on rate increases,” he said.

“That will give us time to work with the industry to ensure that again, every possible solution to keep rates as low as possible is discovered.”

With files from CTV News Edmonton's Amanda Anderson.

CTVNews.ca Top Stories

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.

Keeping these exotic pets is 'cruel' and 'dangerous,' Canadian animal advocates say

Canadian pet owners are finding companionship beyond dogs and cats. Tigers, alligators, scorpions and tarantulas are among some of the exotic pets they are keeping in private homes, which pose risks to public safety and animal welfare, advocates say.

Demonstrators kicked out of Ontario legislature for disruption after failed keffiyeh vote

A group of demonstrators were kicked out of the legislature after a second NDP motion calling for unanimous consent to reverse a ban on the keffiyeh failed to pass.

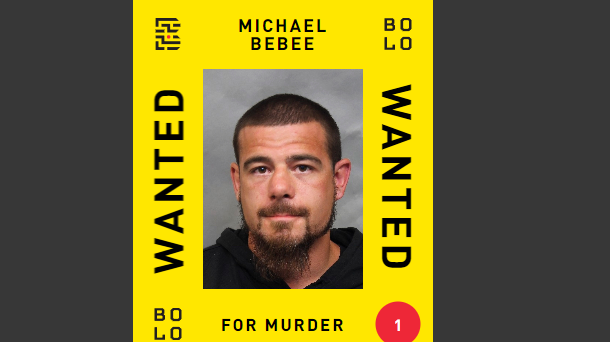

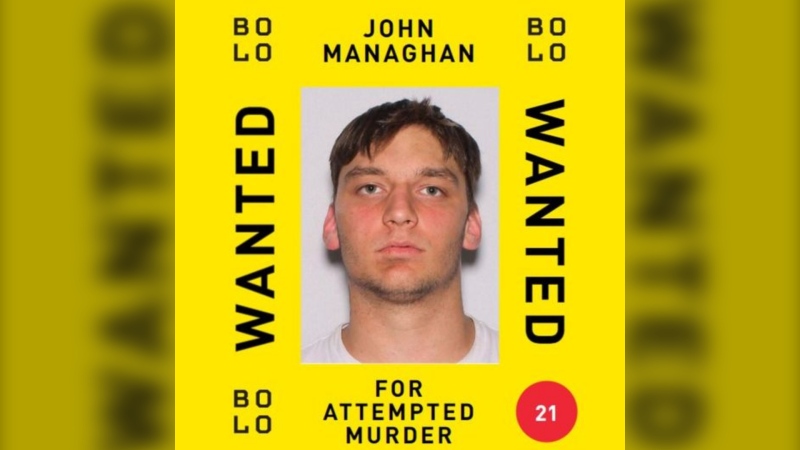

BREAKING Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Prince William and wife Kate thank public for birthday messages for son Louis

Prince William and his wife Kate thanked the public for their messages which had been sent to mark the sixth birthday of their youngest son Louis on Tuesday.

She was the closest she'd ever been to meeting her biological father. Then life dealt her a blow

Anne Marie Cavner was the closest she'd ever been to meeting her biological father, but then life dealt her a blow. From an unexpected loss to a host of new relationships, a DNA test changed her life, and she doesn't regret a thing.

How quietly promised law changes in the 2024 federal budget could impact your day-to-day life

The 2024 federal budget released last week includes numerous big spending promises that have garnered headlines. But, tucked into the 416-page document are also series of smaller items, such as promising to amend the law regarding infant formula and to force banks to label government rebates, that you may have missed.

Fire engulfs old Edmonton municipal airport hangar

A historical hangar at the former Edmonton municipal airport beside the NAIT main campus was on fire Monday night.

Soft skills, preparation can help new graduates land jobs, experts say

As new graduates enter the workforce over the next few weeks, they are likely to face challenges getting their foot in the door and must be prepared to effectively communicate what they bring to the company.