Rental rates in Edmonton, Canada skyrocket while vacancy rates dip

Jeff Howe was dealt a double blow on the money front late last year.

First, he was laid off from his job at the end of October.

Then, a month later, his landlord emailed him to tell him the rent on the half-duplex in which he and his family live was going up in 90 days.

"We weren't given any reason for it," Howe said of the $100 bump in rent to $1,600 a month for the three-bedroom, one-and-a-half bath unit in northeast Edmonton.

"We assume it's because interest rates have gone up."

It's the kind of increase renters across the country face these days.

A recent report from rentals.ca shows rental rates in Canada hit a record high, with the average monthly apartment rental rate in January at $2,146, an increase of 11.6 per cent from a year ago.

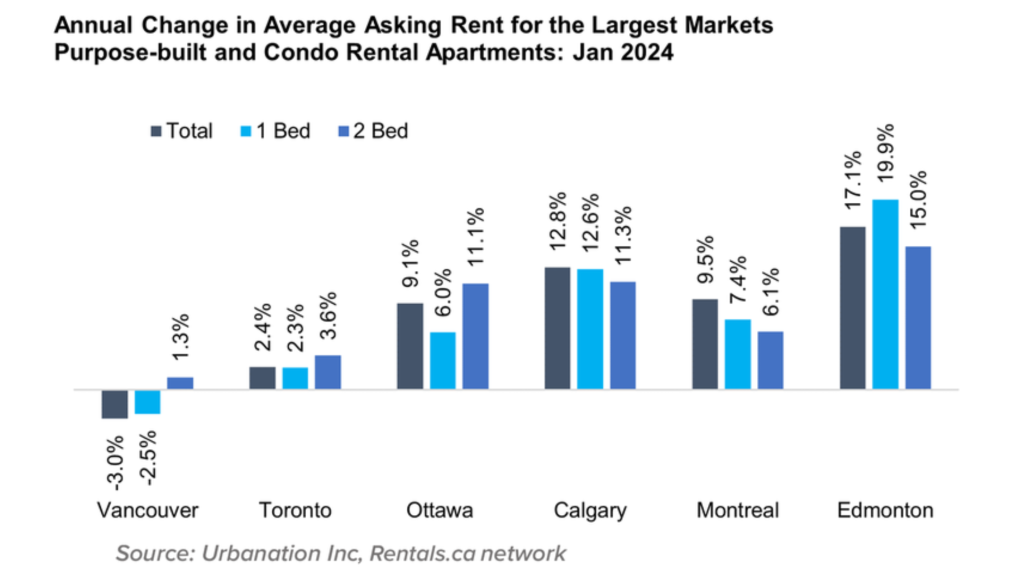

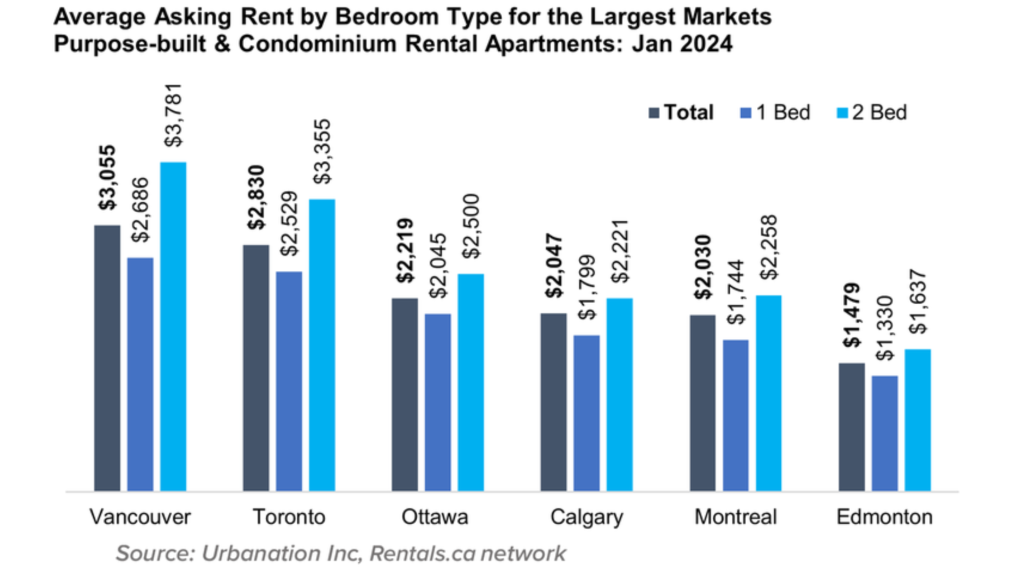

Edmonton, which passed Calgary as Canada's rent inflation leader among large markets according to rentals.ca, saw a 17.1-per-cent annual increase to an average rental price of $1,479. By comparison, Calgary had a 12.8 per cent rise for an average price of $2,047.

The average asking rent in the province is $1,690, up 17.8 per cent from last January, the report said.

For Howe, it means cutting back on costs. He and his wife have cut out eating lunch to ensure their kids "are supported" and can continue with extra-curricular activities.

For Howe, it means cutting back on costs. He and his wife have cut out eating lunch to ensure their kids "are supported" and can continue with extra-curricular activities.

"It means we've got to control our spending, especially when it comes to groceries and what we're buying for the kids," Howe said.

"Those little sacrifices until hopefully things get better."

It might be a while, however.

According to the Canadian Mortgage and Housing Corporation's recent rental market report, Edmonton's vacancy rate for rental apartments fell in 2023 to 2.4 per cent from 4.3 per cent the year before.

The report, published Jan. 31, said 2023's vacancy rate is Edmonton's lowest in almost a decade as rental demand exceeded new supply entering the market.

It said the lowered vacancy rate is steered by population growth, stable economic activity, steady rates of youth employment, people experiencing difficulty buying homes and relatively high interest rates affecting housing supply.

It's a situation that all three levels of government have been trying to address for years now, and recent spikes in prices are on their radars.

Governments draw up plans for rental, housing help

"Rent’s going up in our province faster than other provinces partially because we are the most affordable jurisdiction still left in the country," Jason Nixon, Alberta's community and social services minister, told CTV News on Tuesday.

His province, according to Statistics Canada, experienced the fastest demographic growth in 2023 at four per cent and recorded the highest net interprovincial migration growth rate ever recorded by a province.

"A lot of people will say, including the official opposition right now, they want us to bring in rent control," Nixon said.

"The problem with rent control is that’s just going to stop construction and people entering the industry creating more homes which is the number one thing we need to give affordability to the market."

Nixon did say the provincial and federal governments are working to provide rent supplements for people who spend the majority of their income on rent.

The federal government's Housing Accelerator Fund, which is overseen by the CMHC, has allocated $4 billion across Canada to accelerate the construction of 100,000 new homes over the next five years.

The ruling Liberals already announced funding under the program, including for Toronto ($471 million), Ottawa ($176 million) and London ($74 million).

Federal Official Opposition leader Pierre Poilievre on Thursday talked about his proposal for a program requiring municipalities to hit a 15-per-cent home building target each year, which would also withhold money from cities that don't reach those targets.

It was a plan the Conservative leader first introduced in the House of Commons in September as a private member's bill.

For now, however, those ideas don't help families such as Howe's.

"You know, 100 bucks doesn’t sound like a lot, but when it’s one-and-a-half income family or even a dual-income family it’s a big kicker for people who are trying to get out of the rental system," he said.

With files from CTV News Edmonton's Amanda Anderson and The Canadian Press

CTVNews.ca Top Stories

Donald Trump says he urged Wayne Gretzky to run for prime minister in Christmas visit

U.S. president-elect Donald Trump says he told Canadian hockey legend Wayne Gretzky he should run for prime minister during a Christmas visit but adds that the athlete declined interest in politics.

Historical mysteries solved by science in 2024

This year, scientists were able to pull back the curtain on mysteries surrounding figures across history, both known and unknown, to reveal more about their unique stories.

King Charles III focuses Christmas message on healthcare workers in year marked by royal illnesses

King Charles III used his annual Christmas message Wednesday to hail the selflessness of those who have cared for him and the Princess of Wales this year, after both were diagnosed with cancer.

Mother-daughter duo pursuing university dreams at the same time

For one University of Windsor student, what is typically a chance to gain independence from her parents has become a chance to spend more time with her biggest cheerleader — her mom.

Thousands without power on Christmas as winds, rain continue in B.C. coastal areas

Thousands of people in British Columbia are without power on Christmas Day as ongoing rainfall and strong winds collapse power lines, disrupt travel and toss around holiday decorations.

Ho! Ho! HOLY that's cold! Montreal boogie boarder in Santa suit hits St. Lawrence waters

Montreal body surfer Carlos Hebert-Plante boogie boards all year round, and donned a Santa Claus suit to hit the water on Christmas Day in -14 degree Celsius weather.

Canadian activist accuses Hong Kong of meddling, but is proud of reward for arrest

A Vancouver-based activist is accusing Hong Kong authorities of meddling in Canada’s internal affairs after police in the Chinese territory issued a warrant for his arrest.

New York taxi driver hits 6 pedestrians, 3 taken to hospital, police say

A taxicab hit six pedestrians in midtown Manhattan on Wednesday, police said, with three people — including a 9-year-old boy — transported to hospitals for their injuries.

Azerbaijani airliner crashes in Kazakhstan, killing 38 with 29 survivors, officials say

An Azerbaijani airliner with 67 people onboard crashed Wednesday near the Kazakhstani city of Aktau, killing 38 people and leaving 29 survivors, a Kazakh official said.