Alberta doctors' advocate decries federal capital-gains tax changes

Federal tax changes could soon make it difficult for people to find a family doctor, says the Alberta Medical Association.

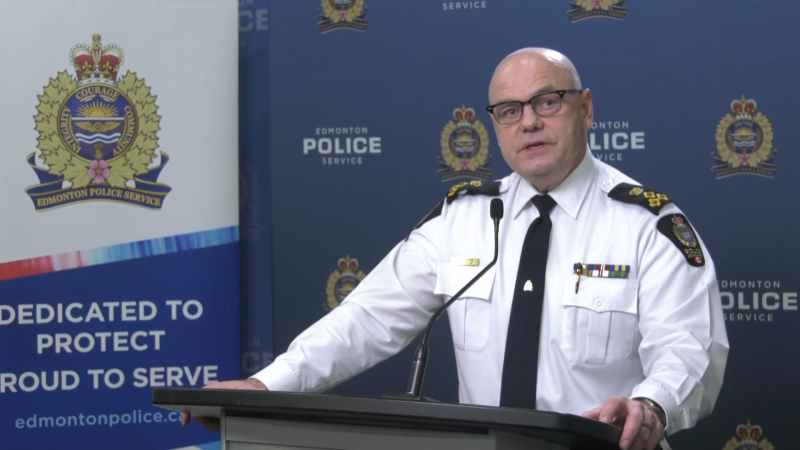

Dr. Paul Parks, the president of the advocacy group for the province's physicians, says the changes will cripple doctors' ability to save money for things such as retirement and make it harder to keep family physicians in the country.

The federal government in its budget presented last month proposes making two-thirds rather than one-half of capital gains — or profit made on the sale of assets — taxable.

The increase in the so-called inclusion rate would apply to capital gains above $250,000 for individuals, and all capital gains realized by corporations.

Ottawa says the changes will only affect the rich, but Parks says average-income family doctors will be left paying the price.

"There's a perception that physicians are making millions of dollars a year. That's not the case," Parks told CTV News Edmonton on Friday, adding that doctors aren't eligible for retirement or pension plans so they establish professional corporations to save money and pay less tax.

He said Alberta family doctors annually are billing "in the neighbourhood of $340,000 a year."

"We know their overhead and their costs to run their business is over $250,000 a year, so maybe before taxes, they are making $80,000 to $100,000 — and many are making less — then they have to contribute into this professional corporation as a mechanism to try to save for their future, and now government is taking some of that as well."

Liberal MP Randy Boissionnault, who represents the federal Edmonton Centre riding, said while he and the finance department are willing to discuss "the unintended consequences of the capital gains tax," Ottawa wants to ensure "that the tax system is fair" and insists the change impacts only the wealthiest Canadians.

Alberta Premier Danielle Smith said the federal tax change is a move that has the potential to push doctors out of Canada, adding she has asked her finance minister to urge Ottawa to scrap the capital gains changes completely.

"We are in the process of trying to attract doctors. This is essentially telling doctors 'go work in America," Smith told CTV News on Friday.

"It has the potential to cost them a huge amount of money in their retirement savings. It's not fair to do that, to change the rules midstream. I think they need to look at other ways to balance their budget."

Chetan Dave, an economist at the University of Alberta, says he doesn't see the benefit of provincial premiers weighing in on federal taxes as they're out of their jurisdiction, adding the change in federal policy that takes effect on June 25 has advantages.

"Every policy is going to have costs and benefits. The benefit of this policy is that it equalizes tax treatment across sources of income at the upper end of the distribution. At the very least, it does that," Chetan told CTV News Edmonton, adding that the cost in the case of doctors is that most of them "especially specialists, are at the upper end of the distribution, so they are going to be negatively affected."

"Now, if you have a problem with the level of taxes, what the federal government or even provincial governments really should be doing is expanding the brackets and lowering rates, but overall, this policy is not a bad policy from an efficiency standpoint because it taxes sources of income equally now at the upper end of the distribution."

With files from The Canadian Press

CTVNews.ca Top Stories

Serial sexual offender linked to unsolved 1970s homicides of four Calgary girls, women

An investigation into unsolved historical homicides from the 1970s has linked the deaths of two girls and two young women in and around Calgary to a now-deceased serial offender.

Woman with liver failure rejected for a transplant after medical review highlights alcohol use

For nearly three months, Amanda Huska has been in an Ontario hospital, part of it on life support, because of severe liver failure. Her history of alcohol use is getting in the way of her only potential treatment: a liver transplant.

Dabney Coleman, actor who specialized in curmudgeons, dies at 92

Dabney Coleman, the mustachioed character actor who specialized in smarmy villains like the chauvinist boss in '9 to 5' and the nasty TV director in 'Tootsie,' has died. He was 92.

Information commissioner faces $700K funding shortfall, says system is 'overwhelmed'

Canada's information commissioner says her office is facing a $700,000 funding shortfall that could impact its ability to investigate complaints about government transparency and accountability.

BREAKING Craig Berube named as next head coach of Toronto Maple Leafs

The Toronto Maple Leafs have named Craig Berube as their new head coach.

Backlash over NFL player Harrison Butker's commencement speech has reached a new level

The NFL is distancing itself from controversial comments by Kansas City Chiefs kicker Harrison Butker during a recent commencement address.

B.C. man 'attacked suddenly' by adult grizzly near Alberta boundary: RCMP

A B.C. man is recovering from multiple injuries after he was "attacked suddenly" by an adult grizzly bear near Elkford Thursday afternoon.

Australia's richest woman seeks removal of her portrait from exhibition

Art is subjective. And while many artists long to share their work with the world, there's no guarantee that the audience will understand it, or even like it.

Person charged in random assault on actor Steve Buscemi in New York

A person wanted in connection with the random assault on actor Steve Buscemi on a New York City street earlier this month was taken into custody Friday, police said.