EDMONTON -- Insurance experts are urging those impacted by flooding in Fort McMurray to contact their insurance providers immediately to determine exactly what they’re covered for.

The western vice president of the Insurance Bureau of Canada says overland flooding coverage is not included in standard policies.

“It is an optional add-on,“ said Celyeste Power. “If you didn’t purchase the coverage, then insurance would not be available.”

And even if they wanted to purchase it, affected homeowners may not have had the option.

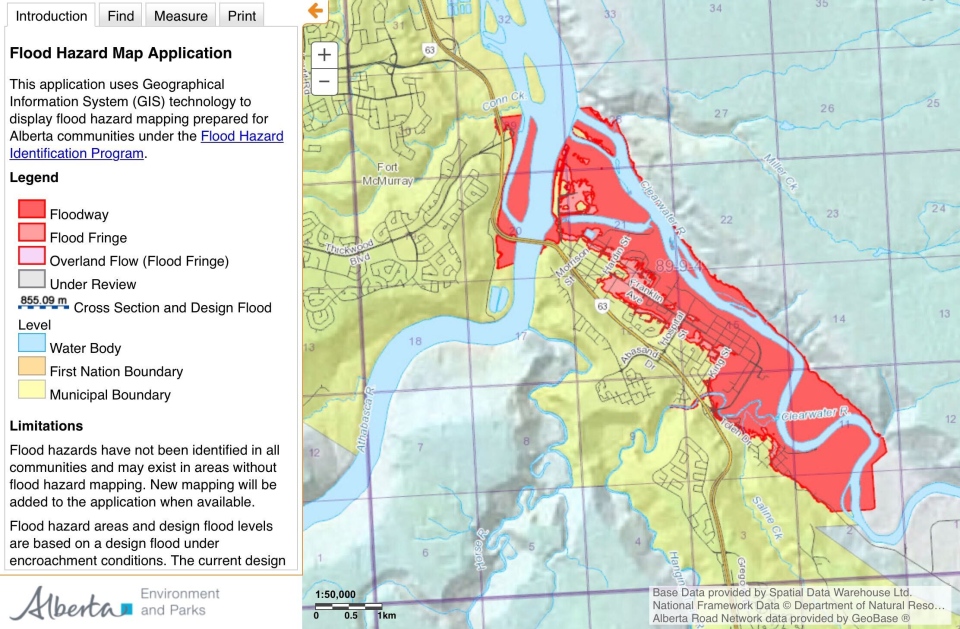

“For folks in very high-risk flood-prone areas like flood plains, that coverage is typically limited or difficult to come by,” said Power. “Certainly one neighbourhood is on a flood plain and most of the area would be in a flood hazard area.”

CONCERNS OVER INSURANCE COVERAGE

One Fort McMurray resident says he has sewage backup insurance but he wasn’t able to purchase overland flood insurance because he lives downtown. His home is now full of water.

“It’s a really bad situation,” said Moe. “Who is looking out for us? No one at this point.”

He calls emergency financial payments being provided by the provincial government “very helpful” but believes home insurers should cover costs associated with the mandatory evacuation.

“We have been calling them every single day saying, ‘Look we need to eat, we need a shelter, we have kids, we need supplies, diapers all that kind of stuff,’ and they’ve been rejecting all we’ve been asking for saying, ‘We’re not covering you.’”

Power says what’s known as “additional living costs” are only covered for disasters included in a resident’s policy.

“I would recommend everyone keep their receipts for working with their insurer,” Power said. “So far this does seem like an overland flood scenario because the water is coming in from the ice jam overland.”

ASSESSING THE DAMAGE

It’s not yet safe for insurance adjusters to get into flooded homes in Fort McMurray but the Insurance Bureau of Canada is getting a better idea of the damage.

“CatIQ, which is an independent survey service from the industry, is doing a survey of the damage and they do not typically survey unless there’s at least $25 million in damage,” said Power. “So it looks like we will pass that threshold.”

According to IBC, the 2016 Fort McMurray wildfires are considered the largest insured catastrophe in Canadian history at an estimated cost of $3.58 billion.