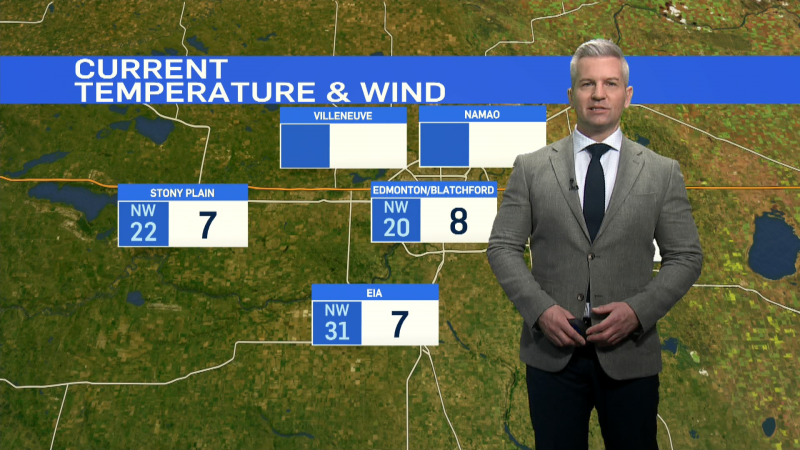

Albertans are more concerned about their consumer debt than people in other provinces, according to the latest MNP Consumer Debt Index.

The quarterly survey found that nearly six in 10 Albertans are worried about rising interest rates and their ability to repay their current debts.

“Albertans are maxed out right now and what makes the situation more alarming is that there is no real plan for paying back what they have borrowed,” Licensed Insolvency Trustee Donna Carson said in a written release. “If the economy deteriorates further or interest rates rise, there’s going to be a significant number who will be forced into bankruptcy or insolvency.”

Consumer insolvencies increased by 5.4 per cent across Canada between February 2018 and 2019, according to the Office of the Superintendent of Bankruptcy. In Alberta, there were 25.3 per cent more insolvencies.

The survey revealed that 48 per cent of Albertans say they are $200 or less away from not being able to pay their bills at the end of the month.

Still, consumer debt continues to increase.

“We’re seeing more and more people having to rely on credit to supplement their income. And that’s a dangerous situation because obviously the individual is obviously going more and more into debt,” said Edmonton-based MNP Licensed Insolvency Trustee Zaki Alam.

MNP LTD recommends getting a clear understanding of your debts and having a plan to repay them.

“Work out, are you able to get out of this debt in the foreseeable three to four years. And if you can, that’s great, stick with that budget. But if you don’t think so, you may need to take further action by seeking the advice of a professional,” said Alam.