EDMONTON -- Tumbling oil prices are forcing Alberta to dip into its reserve fund to keep its $10.5-billion deficit from sliding further into the red.

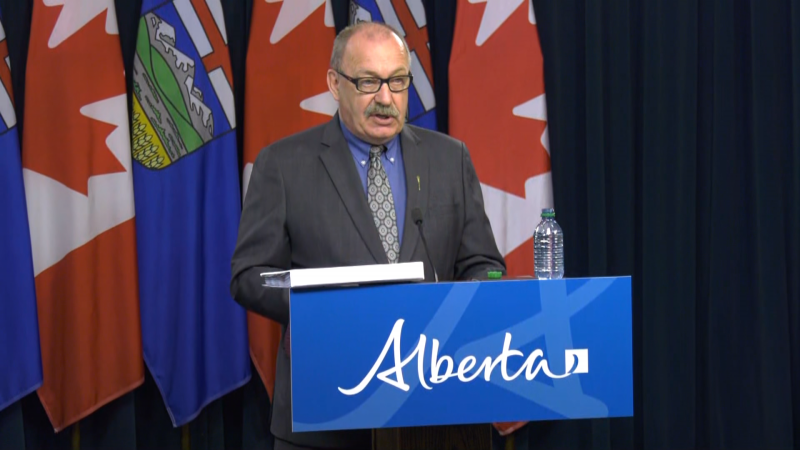

Finance Minister Joe Ceci says in his first-quarter fiscal update that the province had expected the benchmark oil price to average out at US$55 a barrel this year.

Instead, it's hovering below $49 a barrel and isn't expected to rise much in the near term.

Ceci says the province will use half of its $500-million contingency fund to keep this year's deficit from growing.

Numbers reveal that lower-than-expected oil prices are expected to add $291 million to the Alberta deficit by the end of the 2017-18 fiscal year next spring.

The big hit comes from oilsands royalties -- the province had hoped to bring in $2.5 billion this year, but now expects to take in $563 million less.

The government said there are bright signs on the horizon. It expects the economy to grow by 3.1 per cent in 2017, up from the March budget forecast of 2.6 per cent.

Alberta added 17,000 jobs this year and expects employment to rise by 1.3 per cent, higher than the 0.9 per cent forecast in the budget.

The province has been struggling for several years with low oil prices that have siphoned billions of dollars from its bottom line and thrown thousands of people out of work.

Despite the downturn, Premier Rachel Notley's government has committed to ramp up capital spending and stay away from deep cuts to operational spending. Notley has said it's the best approach to catch up on infrastructure and keep the economy going in tough times.

Opposition politicians have said the government needs to do a better job reining in spending to avoid saddling future generations with debilitating debt-interest payments.

The province has been hit with multiple credit warnings and downgrades in the last two years.